Rob Schuham, investor, serial entrepreneur, and Co-Founder of Undercurrent, discusses the underlying mechanics of civilization and how we arrived at such a fragile place. He breaks down the basics of fragility, what we’re building resilience for, and the expansiveness and complexity of system inter-connectivity, as well as the unintended impacts of capitalism.

Read the Transcript

Bud Caddell:

The very first thing though that I want to do, and this is really special to me, is I want to invite Rob Schuham to come up. He’s so many things. He’s an investor, he’s a serial entrepreneur. He’s an advisor, he’s a mentor, he’s a partner of mine, he’s a former boss of mine. He has incredible insight into what’s happening right now in the world. And I want to introduce him to everyone and I just honestly want to have an opening just quick conversation with Rob because Rob and I have been with so many people talking about how this all happened. And so Rob, please say hello to everyone and jump on in. How did we get here, Rob? Tell us.

Rob Schuham:

Can you see me and hear me okay?

Bud Caddell:

I can see you and hear you just fine.

Rob Schuham:

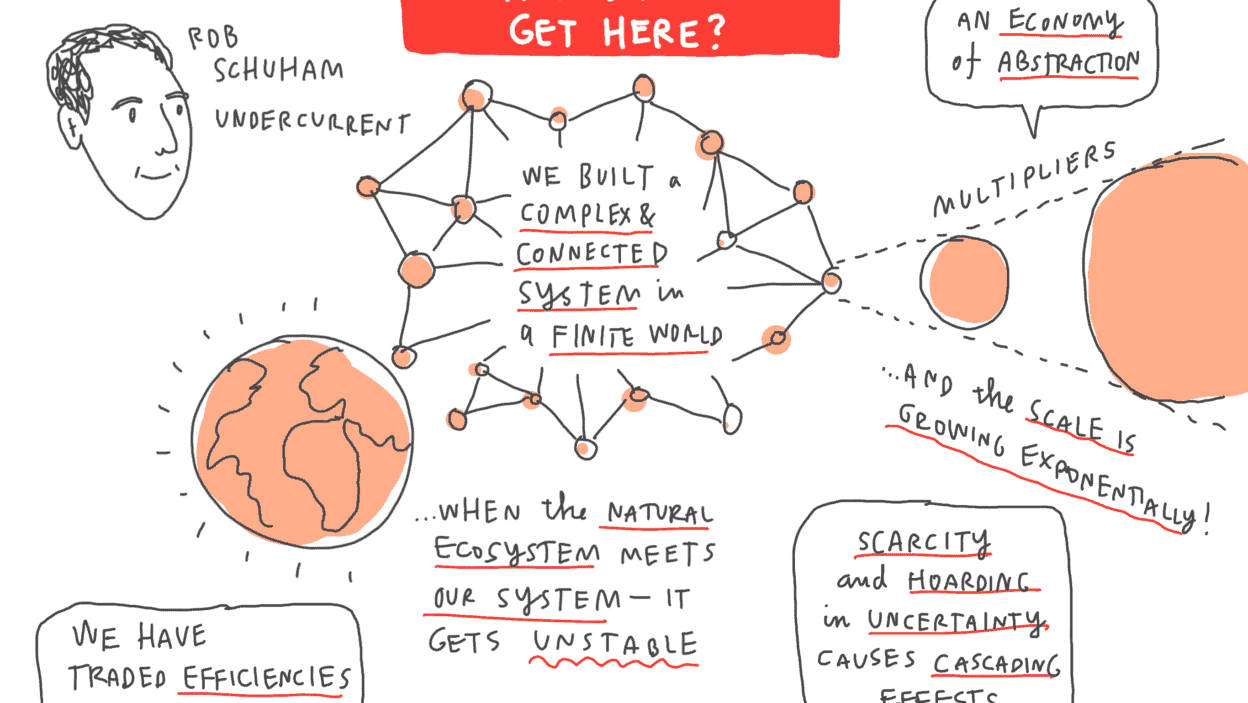

Awesome. Great. Yeah. How did we get here. First of all Bud, thank you. I think we’re in the mutual admiration club with each other. Bud was employee number five at Undercurrent. So, that’s how we got to know each other, but you have blossomed into somebody that I have massive admiration and respect for. So, I’m honored to be here. I’m honored to be working with you in the capacity. And I guess where I wanted to start was, for the last 10, 11 years I’ve been deep in the climate movement. So, I’ve been looking at the fragility of our ecosystems, our environmental ecosystems specifically. And that started to take me on a journey where I met with many other brilliant people whose who, who had been investigating what are the underlying mechanics of civilization and how did we get to such a fragile place? Where we have zootrophic leaps from animals to humans and we have pandemics that get created that trip financial systems into complete disarray.

Rob Schuham:

And maybe what I’ll do is I’ll just go back to what does the whole notion of fragility need, right? So, for building resilience, the question is what are we actually building resilience for? And we’re building resilience for essentially almost this global system fragility that we’re living in, where everything is connected to everything. Our systems are open, they’re complicated, and when something happens in one system, we end up with cascading effects in other systems and it’s almost like a quantum physics exercise. We joke about the matrix a lot, and the challenge is how do you see the matrix? How do you see through it? How do you see around it? And especially when the matrix is actually dimensionality at an exponential rate. And if I go to the environmental piece, which is a place that I always like to start, we live in this finite world.

Yeah, we operate like it’s infinite, right? We can endlessly pollute the skies. We can dump plastic in our oceans, we can poison our water systems, right? There’s no accountability and what’s essentially happened is this thing called capitalism has grown up and become massive and has created all of these unintended consequences, which then have resulted in all of this externalized harm, which never actually gets accounted for, right? And so, we have effectively debased nature, right? We’re in this world where a shark is worth more dead than alive for its fins in certain countries to make soup. An elephant is worth more dead than alive for its tusks and its ivory to some people. And importantly, to this conversation, so are the trees and the forest and our precious biodiversity and this human economy footprint that we’ve been co-creating to a certain extent and expanding has resulted in this relentless expansion of development, of mining, degenerative agriculture.

And it’s encroached on our remaining wilderness and our precious rain forest, right? So, epidemiologists have been sounding the alarm bell for years, right? That these altered landscapes have enabled these infectious diseases to more easily make the leap from animals to humans. And that’s an example of where a natural delicate ecosystem meets with a manmade delicate ecosystem. And so, in this case of these novel viruses, right? We’ve basically… We have not developed as human beings any kind of capacity to deal with these kinds of viruses. And so, we blew this plant and animal balance, right? And so, mother nature in effect is slapping us back right now and we’re feeling it pretty significantly. The other place we’re feeling it right now is of course in our economy.

And I think we’ve all watched with horror the stock market or our 401ks, our retirement accounts. But most importantly, people that are really close to us and dear to us who are getting laid off, losing their jobs, the service industry. All that collapsing except for the digitized ones. And if the economists who are watching this will just give me a little bit of spaciousness for a second. I’m wanting to take you to how we ended up in such a delicate ecosystem place, in that place where we are right now, right? And there’s three, I’m going to call them rough phases, right? They’re the linear phase, the multiplicative phase and the exponential economy phase. And the first phase, the linear phase, was if you go back in time, right?

Economic output was essentially proportional to input. Plowing the field for example, right? Resulted in, you grew things, you took them to market, you exchange them for either money or goods or services, blacksmithing, basket weaving, right? All the old trades and guilds and stuff like that, but there was a symmetry in that form of capitalism. It was very much one to one. Then, it phase shifted into this multiplicative economy, right? Where all of a sudden you had surplus, right? We went from being hunters and gatherers and those of you who’ve read sapiens, you probably are well aware this, right? To farming, to then storage and once we started storing food because we were able to save the surplus, that’s when the construct of ownership kicked in, right? And so, when ownership kicked in, what you found is you found people that were able to start renting property because they were able to save and buy more property and then lease it to another farmer for example, right?

They were able to make loans. It was the rise of middleman, right? The emergent energy economy way back in the beginning, right? But what was happening is you are now setting up a situation where you could radically out-compete others. And what happened was that symmetry started switching into asymmetry and then we started having wealth inequality when people were making money from the activity of other people. Okay. So, that’s the capitalism I think that we still think in and that’s where our context is. But really what’s going on is there was another massive phase shift and we’re all witness to it because we’re in it right now, which is the exponential economy. And what happened was is you started adding multiplier effects onto the multiplicative economy, and what we evolved to was pure financial services. Interest accrued on interest for example, right?

Fractional reserve banking, a digital economy, which was actually able to engineer out scarcity in some way, shape or form, right? Making money at a scale that was otherwise completely unachievable in a multiplicative economy, right? So, an example is an app store where you can sell the same app to billions of people or central banks making money on the money that’s used by all our people. The thing that the multiplicative and unexpected exponential economies have in common with each other is they’re built on these… It’s like a three legged economic stool, right? It’s scarcity, extraction and hoarding. And those are three behavior dynamics in our economic system right now. And then you combine that with this exponential economy that’s actually very abstract. Most of the people in this world have no clue where the money’s actually coming from.

They don’t know what a money supply is, right? They might have stocks in their 401ks, but nobody can tell you the beginning or the end or how the stocks got to where they were. We’re gauging actual performance in this real time, or we’re gauging it in arrears. But what we’re not actually able to do is tell you with any concrete or tangible way how the system actually works. So, it’s almost an economy of abstraction. Now I’m going to bring the two together, right? How, for example, do we have these cascading environmental impacts and how do they interact with the economy? Well, I’m going to start with this. Uncertainty breeds uncertainty. Okay, so let’s go back to environmental degradation, right? A pandemic hits, what does that create? It creates a massive amount of uncertainty.

What does uncertainty do? Well, it tricks the circuits on two of the three behavioral underpinnings of the economy, which is scarcity and hoarding. Witness what’s happening in the food stores, right? When those things become inflamed, right? It’s almost like shooting a bazooka missile into this abstraction economy. And then what happens is you get all these massive cascading effects that occur. So, when I talk about system fragility and interconnected systems, look at what’s happening right now, right? So, from a geopolitical standpoint, governments are actually starting to cooperate a little bit, but until this moment, we’re not always cooperative, right? Another system, our actual national government system that we’re sitting in here, right? We have total instability right now and we have really awful sense making that’s happening, right? So, this is part of the cascading effects, right?

We have civic infrastructure overwhelmed right now. So, national government or federal government’s interaction with states and locals, not very good right now. It’s getting better, but it really started off from a very unstable place. The financial systems, right? We never really healed from 2008. We just did, right? We didn’t actually put all the mechanisms in place to shore up the financial system in a way that made concrete or tangible sense. And then I’m going to take it into two places that are impacting us right now and then I’ll hold for a second, right?

Bud Caddell:

Okay, bring us all around.

Rob Schuham:

Okay. Italy’s throwing the towel in right now, right? Because their medical system is another delicate ecosystem that’s suffering from a set of cascading effects. Supply chains are being interrupted so we end up with resource depletion and I’ll stop it on this note right now, which is we live in a system where we have totally traded efficiencies for durability. Okay, and it’s all because of money. And what’s essentially happened is we have just in time manufacturing, right? We have food crops being harvested to meet just in time needs of human beings. All of that is failing right now. So, that’s what I need when I talk about cascading effects, system fragility and what we’re sitting in right now.

Bud Caddell:

Yeah. Oh my God, I would love to… You and I have done this for days straight. So many people while you were talking were cheering you on and want to hear more about this stuff and I know that our fellow panelists are also going to talk on a lot of the categories too. Rob, it was so great to have you. Just a plug for you and the partnership and Nobel is the reboot of Undercurrent to serve leaders who are starting to look at their organizations and look at the world and have a personal transformation within themselves and have a hard time figuring out how to do that within the walls of their companies. And so, I very much would drive folks to you and you’re on our website and to the Undercurrent website if they’re interested in learning more about that. But thank you so much, Rob.

Rob Schuham:

Sure, of course. Apologies to everybody. I saw in the chat that people were saying slow down. So, maybe we can use the panel to break some of this stuff down.

Bud Caddell:

Yeah. Thank you so much.

The Evolutionary Edge

Every Link Ever from Our Newsletter

Why Self-Organizing is So Hard

Welcome to the Era of the Empowered Employee

The Power of “What If?” and “Why Not?”

An Adaptive Approach to the Strategic Planning Process

Why Culture/Market Fit Is More Important than Product/Market Fit

Group Decision Making Model: How to Make Better Decisions as a Team